Let’s talk rates, specifically rate buydowns. If you know what a rate buydown is, excellent! If you don’t, welcome to short and sweet version courtesy of Justin.

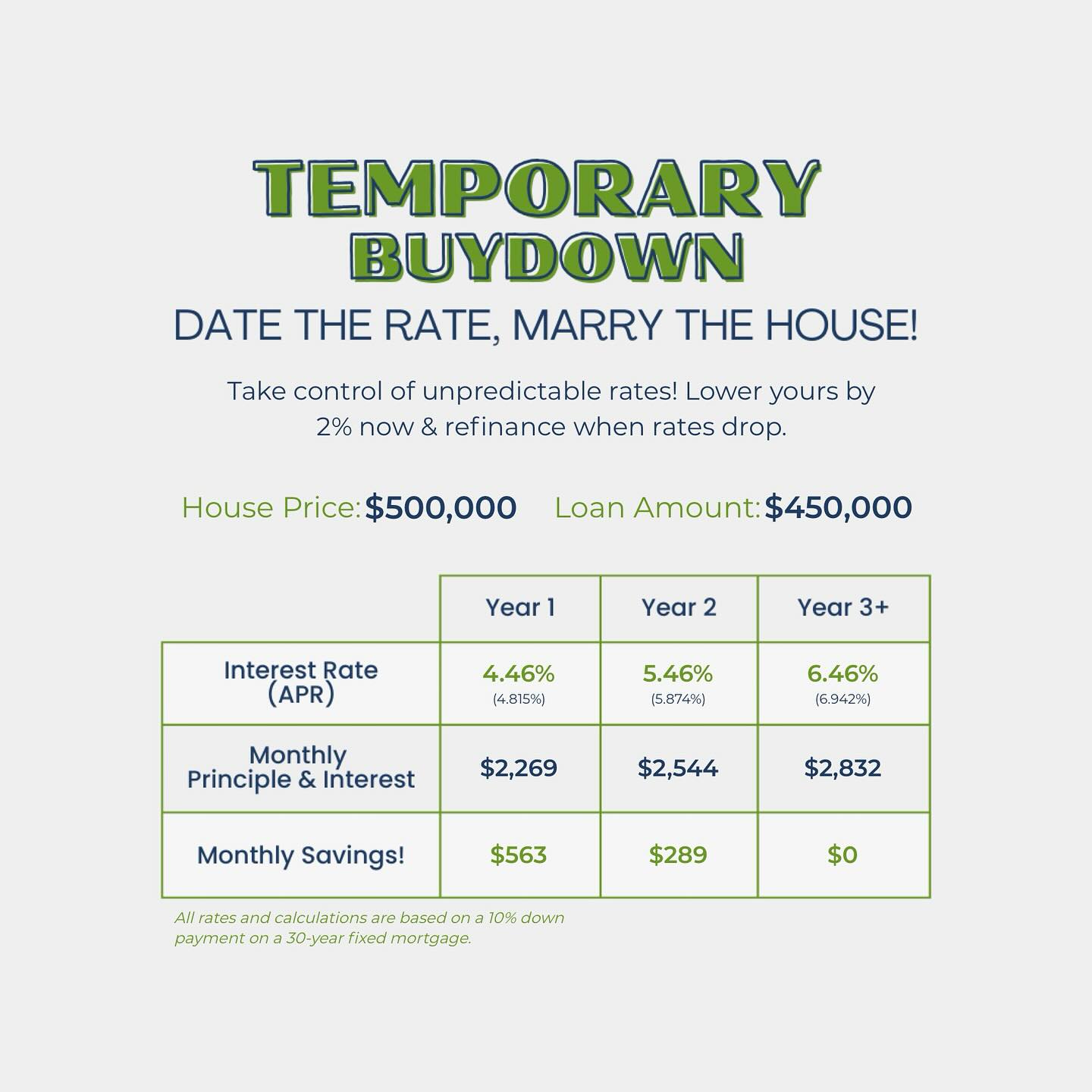

A rate buydown is an effective tool to lower your payment for the first couple of years of a mortgage. How does it work? Pretty simply, it is exactly what it sounds like. During the closing process, the first 2 years are “prepaid” (the difference between the rate and the bought down rate). Currently rates are right around 6.5%, and with a 2-1 buydown, the rate year 1 would be 4.5%, the rate year 2 would be 5.5%, and year 3 on would be 6.5%.

If you were to refinance around 18 months, any remaining “prepaid” interest could be used by whoever is refinancing for loan costs or prepaids. Ultimately, rate buydowns are an amazing tool (especially when rates are typically higher than someone would like) to help buyers get into a home and start building their wealth.

Have an amazing day and keep being awesome!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link